What Is the Credit Period? Understanding How FMCG Trade Moves on Timely Trust

Long-term success in FMCG depends not only on pushing products, but also on smart payment timing. Let’s explore how the credit period shapes manufacturer‑retailer partnerships.

Everything moves fast in the FMCG sector. But behind the rapid movement of goods lies something far more deliberate: the timing of money. When products are delivered before money is collected, it creates a window known as the credit period, i.e, a critical financial lever in everyday trade.

Across the manufacturing industry, understanding the credit period meaning helps facilitate large-scale product movement. Retailers and distributors receive goods, sell them, and pay manufacturers after an agreed period. The system works on trust, performance, and close coordination.

For us at HCCB, as we work with thousands of trade partners across India, the credit period is seen as a mechanism that balances trade expansion with financial health. For beverages, where demand is steady and peaks are seasonal, managing credit effectively supports continuous availability and sustained partner relationships.

What Is the Credit Period?

Simply put, the credit period is the agreed number of days between the delivery of goods and the payment for those goods.

It's a working capital arrangement that keeps stores stocked, vendors operational, and manufacturers on schedule. Typical credit periods in India can range from 7 to 30 days, though they vary based on

- Partner type (retailer, wholesaler, or distributor)

- Category velocity (perishable vs non-perishable)

- Historical paymentpatterns

- Geography and market maturity

In high-volume categories like beverages, the credit period has to be tightly aligned to the shelf life of the product and the sales velocity in that market. A solid understanding of credit period meaning ensures this alignment supports smooth trade cycles.

Why Credit Periods Exist in FMCG Trade

The FMCG business runs on high volumes, fast rotation, and continuous replenishment. These characteristics make credit periods essential in keeping the system functional and balanced. Let’s break it down by benefit:

For Retailers

- Allows inventory purchase without upfront payment

- Enables them to stock a wider variety

- Supports small stores with tight cash flow cycles

For Distributors

- Helps maintain supply continuity across multiple retail points

- Reduces the need for large working capital upfront

- Supports expansion into newer markets

For Manufacturers

- Speeds up product placement, especially in competitive or emerging markets

- Builds stronger relationships with on-ground trade

- Drives repeat ordering and loyalty

The credit period meaning comes to life in how each party leverages this system to support growth and efficiency.

What Happens When Credit Is Too Long?

Longer credit might feel like a win for retailers, but it has side effects. For manufacturers and distributors:

| Impact | What It Looks Like |

| Working capital pressure | Delayed payments stall reinvestment in raw materials or logistics |

| Inventory risk | Unsold goods block space and may expire or get damaged |

| Partner unpredictability | Lack of timely payment history complicates forecasting |

Some manufacturers institute credit freezes if outstanding amounts cross thresholds. Others link future discounts to past repayment behaviour. All of this highlights why a clear grasp of credit period meaning is critical for managing trade risks.

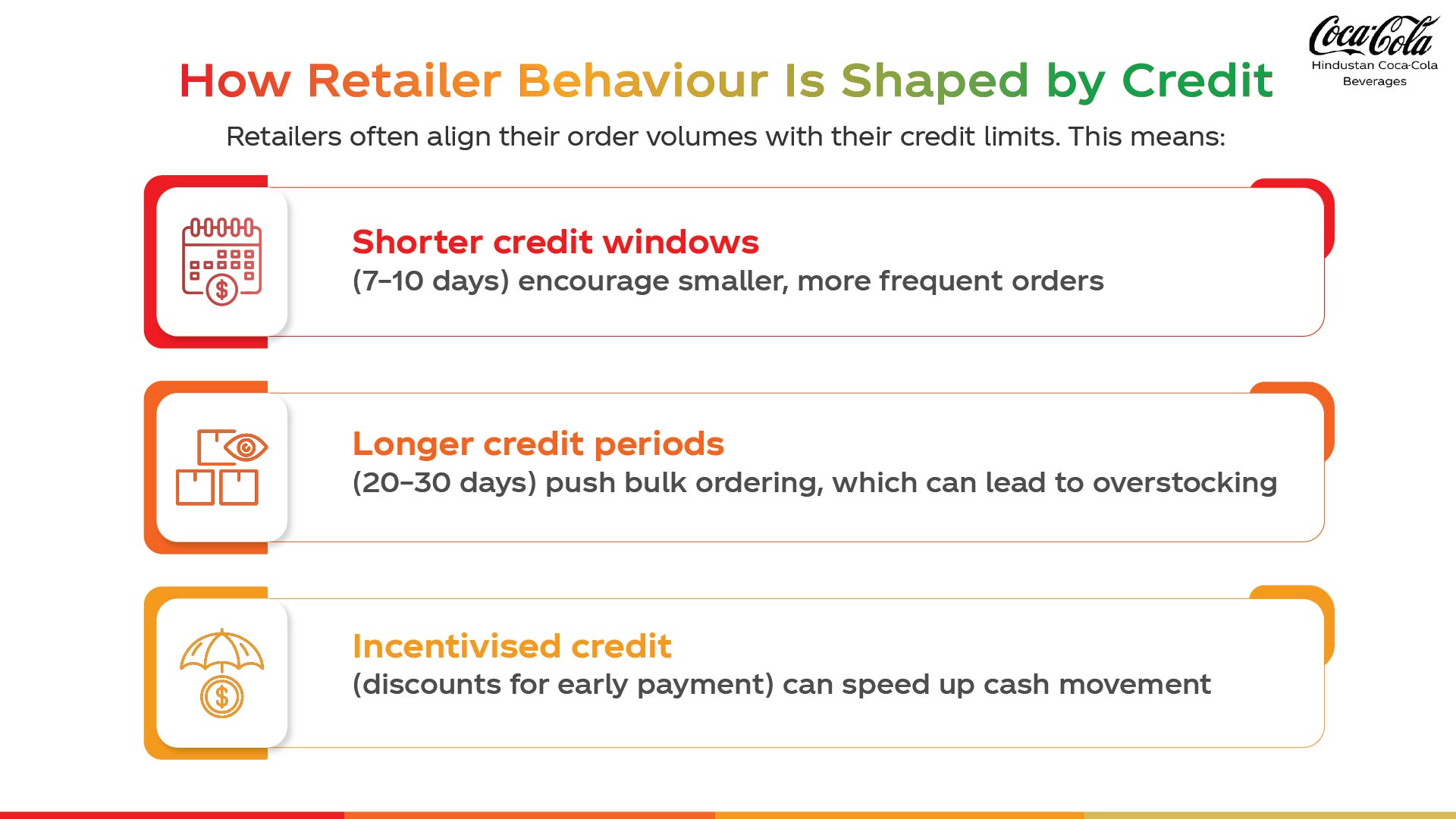

How Retailer Behaviour Is Shaped by Credit

Behaviourally, credit also creates a feedback loop:

- Retailer delays → Reduced trust → Tighter credit next cycle

- Retailer pays early → Builds trust → Higher credit or faster delivery

The key is consistency. Partners who pay on time often get priority during stock crunches, festival seasons, or new product allocations. These cycles illustrate the impact of credit period meaning on everyday trade decisions.

How Manufacturers Manage Credit Periods

Manufacturers in FMCG manage credit periods through structured practices that keep trade flowing while protecting financial discipline.

1) Segmenting Trade Partners

Manufacturers group distributors and retailers based on:

- Order volumes

- Payment history

- Market stability

Reliable partners may receive longer credit, while new or high-risk accounts have tighter terms to reduce exposure. This system relies heavily on knowing the credit period meaning for each partner segment.

2) Aligning Credit with Product Movement

Credit periods are set in line with how quickly products sell in each market. If a beverage typically sells through in 12 days, the credit term mirrors this cycle to prevent overstocking and delayed payments.

3) Using Technology for Visibility

Tools like Distributor Management Systems (DMS) and dashboards help manufacturers:

- Track invoices and outstanding payments

- Monitor credit utilisation by partner and region

- Provide field teams with real-time data before accepting new orders

4) Encouraging Timely Payments

Early payment incentives such as small discounts or priority restocking motivate partners to pay on time, improving cash flow without aggressive follow-ups.

5) Maintaining Clear Policies

Credit limits are communicated in advance. Partners understand that consistent delays can affect future supplies, ensuring accountability without straining relationships.

6) Adapting When Needed

During festivals, peak seasons, or strategic launches, manufacturers may temporarily adjust credit terms to support higher volumes while ensuring clear repayment timelines.

Role of Field Sales and DMS

Field sales teams play a crucial role in managing credit on the ground. They are the first point of contact for partners and help ensure payment cycles remain healthy while maintaining good relationships.

They:

- Remind partners of upcoming and overdue payment dates during visits

- Reconcile invoices and confirm received quantities to clear discrepancies

- Flag delays, disputes, or damaged stock claims early so issues do not escalate

- Support payment collections while continuing regular order taking to keep stock flowing

Many teams now use mobile apps synced with Distributor Management Systems (DMS) to view real-time partner credit status. Before taking new orders, they check available credit limits to avoid over-invoicing partners who are close to or over their limit.

This process reduces disputes, keeps credit cycles disciplined, and ensures sales and collections move together without friction. All of this reflects how well-integrated the credit period meaning is across sales and operations.

How Credit Periods Impact Consumers

Consumers may not directly negotiate formal credit terms with manufacturers, but they experience the effects of credit flows in their daily purchases.

Here is how credit periods influence the consumer experience:

1) Availability: Delayed payments upstream can slow down replenishment, leading to empty shelves and stockouts of favourite products.

2) Freshness: Extended credit can sometimes encourage overstocking by retailers, increasing the chances of older inventory reaching consumers.

3) Choice During Peak Demand: Retailers managing cash flows may delay reorders, reducing brand availability during festivals or high-demand seasons.

4) Informal Credit at Retail

In many neighbourhood stores, consumers take goods on informal credit, paying later based on trust. While not formalised like trade credit, it extends the credit chain down to the consumer level, impacting shopping behaviour and store loyalty.

Credit as a Lever, Not a Liability

Credit periods are tools that influence how inventory moves, how trade partners behave, and how businesses maintain financial health. When used effectively, the credit window fosters trust, ensures a smooth flow, and strengthens long-term partnerships. However, it requires robust systems, ongoing visibility, and team alignment.

Manufacturers that manage credit periods proactively avoid bottlenecks, reduce write-offs, and maintain stronger retailer relationships, especially in a country where trade still thrives on handshake agreements and timely settlements.

Comments