Understanding ROI in FMCG Trade Partnerships

Turn every trade rupee into a measurable outcome with a sharper understanding of ROI in FMCG partnerships

FMCG brands do not grow by distribution alone; they grow through partnerships. These partnerships span distributors, wholesalers, retailers, and modern trade outlets, each forming a crucial node in how products reach shelves and stay visible to consumers. Across this network, brands invest continuously: in discounts, visibility, stock placements, loyalty incentives, and co-branded campaigns.

But how do you know what’s working?

Return on Investment (ROI) is the metric that brings accountability to this system. It helps brands evaluate whether each trade input is delivering more than it costs; whether a discount led to incremental sales, whether a promotion influenced purchase behaviour, or whether a retail tie-up boosted both sales and reach.

For categories like beverages, where volumes are high and margins are carefully managed, measuring ROI is the difference between a sustainable trade engine and an expensive experiment.

What Counts as a Trade Investment?

Before calculating ROI, you need to know what you're evaluating. In the FMCG context, trade investments include a range of activities and resources extended to partners to drive growth and visibility.

Some common examples include:

- Trade discounts and margin support

- Incentives for achieving sales targets

- Visibility investments such as in-store branding, standees, chillers, or gondolas

- Promotional schemes like buy-one-get-one, bundled offers, or introductory pricing

- Distributor infrastructure support or digital enablement tools

Each of these initiatives carries a cost. ROI helps assess whether these costs are converting into value.

How to Measure ROI in FMCG Trade Partnerships

There’s no single formula that fits all brands. ROI measurement must align with business priorities. However, a basic framework includes:

1. Define the Input

What was the total investment made into the partnership or program? This includes monetary spend, product giveaways, infrastructure cost, and manpower hours.

2. Capture the Output

What did the business gain as a result? This could include sales uplift, market share gain, increase in outlet reach, or faster stock rotation.

3. Calculate ROI

At its simplest:

ROI (%) = [(Gain from Investment – Investment Cost) / Investment Cost] × 100

For example:

If a trade scheme cost ₹10 lakhs and resulted in incremental sales worth ₹15 lakhs, the ROI would be:

[(15 – 10) / 10] × 100 = 50%

But the goal is not only to get a percentage. It is to understand which investments are scalable, repeatable, and aligned with long-term brand value.

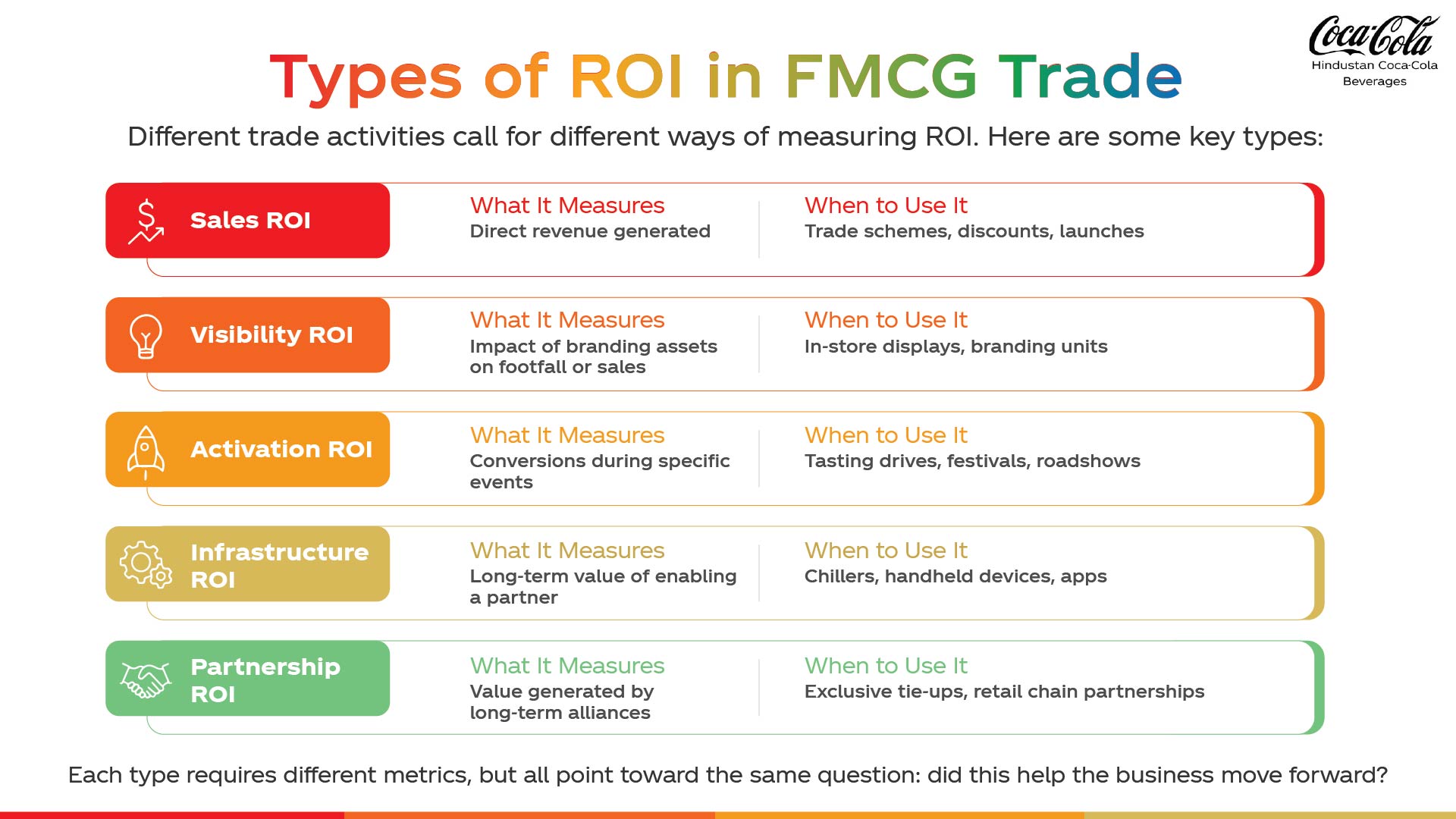

Types of ROI in FMCG Trade

Where ROI Gets Lost

Many brands struggle to measure ROI accurately—not because the investments are wrong, but because tracking is weak or inconsistent.

Common pitfalls include:

- Poor visibility beyond primary sales

- Lack of real-time data from retailers or secondary points

- Measuring outcomes in isolation from investment timelines

- Rewarding volume alone, without considering efficiency or reach

- Relying on static trade spends, even when ROI falls

When systems do not close the loop between investment and output, ROI gets diluted.

Digital Tools Are Changing the Game

The rise of retail technology and trade automation has made ROI tracking sharper and more real-time.

Examples of tools helping FMCG brands measure trade ROI more effectively:

- Sales Force Automation (SFA): Tracks outlet-level movement and scheme redemption

- Distributor Management Systems (DMS): Logs how much product was pushed and at what price

- Retail Intelligence Platforms: Monitor on-shelf presence, footfall, and campaign impact

- ROI Dashboards: Integrate sales and cost data to provide zone-wise or partner-level ROI reports

Brands using these tools are able to run pilot campaigns, track lift, and scale what works. They also reduce dependency on gut feel.

ROI Is Not Just for Head Office

Field teams, trade marketers, and distributor partners all benefit when ROI is part of daily decision-making.

For example:

- A sales manager might choose to allocate extra visibility assets to stores with higher returns.

- A regional head may revise partner incentives to focus more on coverage rather than only volume.

- A distributor might improve order planning if ROI metrics show poor shelf-offtake despite high stock.

When ROI becomes part of the trade language, it shifts the focus from activity to outcome.

Balancing Short-Term Gains with Long-Term Value

Sometimes a trade scheme delivers excellent short-term ROI but does not contribute to long-term brand equity. At other times, a partnership with modest immediate returns may unlock a strategic route to market.

FMCG brands must evaluate both.

Questions to ask:

- Did the trade activity increase consumer trials or repeat purchases?

- Was the gain dependent on heavy discounting or did it reflect organic pull?

- Did the partner relationship grow stronger as a result?

- Is the investment repeatable in other geographies or channels?

True ROI sits at the intersection of short-term growth and sustainable value.

ROI Is Not Optional, It’s Foundational

In trade partnerships, what gets measured gets better. In this, ROI acts as a decision-making compass. It tells brands which channels are performing, which investments are stalling, and which partners are driving real growth.

For large-scale beverage portfolios and diverse retail formats, ROI brings much-needed clarity to a complex ecosystem. It allows teams to prioritise high-impact partnerships, optimise spending, and stay agile in competitive markets.

In the end, the goal is not just to sell more. It is to sell smarter.

Comments